Week 14: Uncertain Yet Exciting Times Ahead

Apple launches savings product, Netflix reports positive earnings, Fed contemplates rate hikes

💡Did you know? Kongō Gumi, a Japanese construction company, is the longest-operating company in the world. It started its operations in 578 AD, constructing Buddhist temples using traditional methods & tools. In 2006, the company was absorbed into Takamatsu Kensetsu and has been operating as a subsidiary since.

📈 Market Rundown

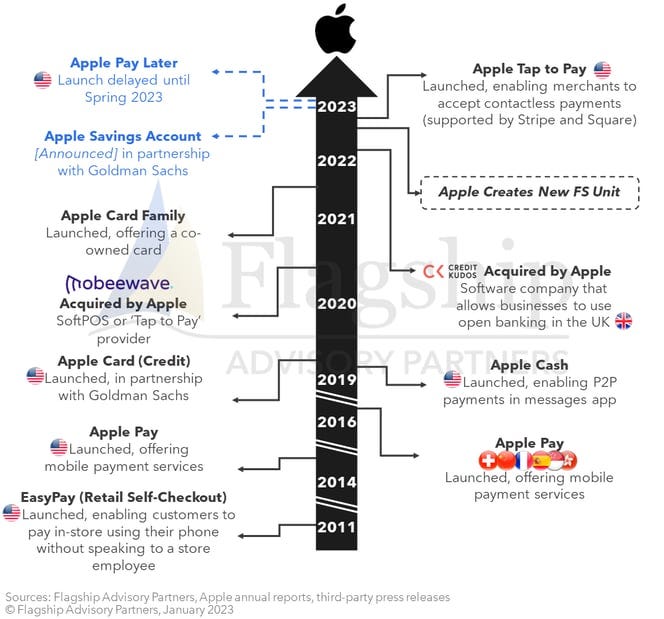

💪 Apple: Solidifying Position in the Fintech Market

📝Quick Recap:

Recently, Apple has launched a savings account product, offering consumers a 4.5% annual yield on their savings. Apple’s move into the fintech space poses a significant threat to incumbent fintech players. Why?

Apple controls the most extensive distribution platform in the world — the iPhone — which has enabled the firm to collect data and build strong brand loyalty among its customers, crucial factors in acquiring and retaining customers in the fintech space. Moreover, with its $50 billion in cash, Apple has the resources required to successfully scale its fintech ecosystem, a major competitive edge vs. existing incumbents. With all these advantages, it is a no-brainer that Apple has decided to enter the fintech space.

In fact, Apple has taken a page out of the fintech playbook and slowly but surely implemented it over the past decade. For instance, Apple entered the fintech space by capturing customers’ high-frequency activities (e.g., transactions) via its Apple Pay & Apple Card products before entering high-value products (e.g., loans). As of 2022, Apple has processed ~$6 trillion in transactions, surpassing Mastercard!

Now, the question is, which high-value fintech offerings would Apple pursue? Apple has announced its interest in entering the Buy-Now-Pay-Later market, allowing it to build a sticky customer base by providing financing options to millions of customers who purchase Apple products globally. Eventually, I foresee Apple deepening its roots within the consumer-facing markets, providing collateralized loan products to minimize risks on the firm’s balance sheet while gaining revenue upside, but only time will tell.

🏆 Netflix: Slow and Steady Wins the Race

📝 Quick Recap:

For Q1 2023, Netflix reported $8.1 billion in revenue (~4% YoY growth) and a 21% operating margin (from 25% a year earlier), beating market expectations. However, the firm reported a muted forecast for the coming quarter as it faces macroeconomic headwinds.

As mentioned in my earlier article, we need to closely monitor Netflix’s performance across the following dimensions moving forward:

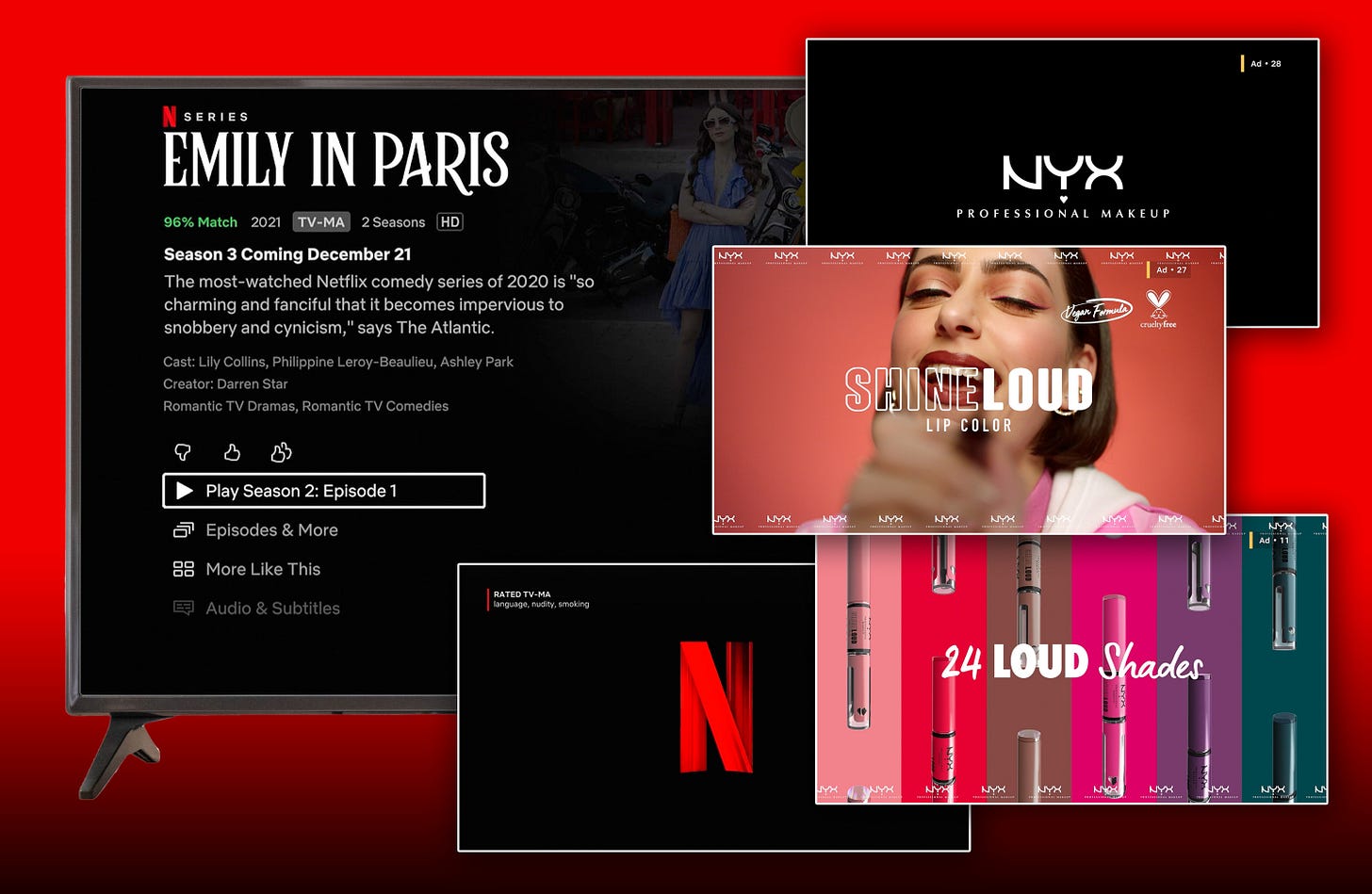

1) How effective is Netflix in scaling its ad-based subscription

2) How effective is Netflix's crackdown on account sharing

Scaling ad-based subscription revenue: Netflix has reported "better than expected" engagement and little to no switching from its premium to ad-tier plans. In other words, Netflix has seen an incremental revenue uplift from its ad-tier plans, providing positive news before a broader rollout to APAC markets.

Additionally, Netflix is investing heavily in building a suite of features for advertisers to effectively target and monitor ads on the platform, a crucial step in gaining a competitive edge over the long term. Netflix would need to eventually differentiate its ad product offerings vs. its competitors, which is only possible via building solid ad-targeting capabilities.

Crackdown on account sharing: Netflix is still testing its new shared accounts model in different markets before a wider rollout. The management has reported positive results, indicating consumer behavior similar to that of a price increase:

"We see an initial cancel reaction. Then we build out of that, both in terms of membership and revenue as borrowers sign up for their own Netflix accounts, and existing members purchase that extra member facility for folks that they want to share it with. … So to get to a positive outcome, you mentioned Canada, we're now in a positive member and positive revenue position relative to pre-rollout." — Greogory Peters, Co-CEO

If reactions to account sharing are similar to those of the tested markets, then it is fantastic news for the firm. Netflix will be in a solid position to monetize from 100 million users from whom it currently does not generate revenue from.

🤔 Fed: Contemplating Future Rate Hikes

On the backdrop of rising wages and persistent inflation driven by the services sector, the Fed is contemplating another quarter-point rate hike for May — Should it let inflation run wild, or should it raise rates further at the cost of additional bank failures?

A difficult choice to make. Nevertheless, the Fed has been taking active steps to minimize downside risks. For instance, the Fed has conducted daily liquidity check-ins with banks and ensured that they have the necessary paperwork to quickly borrow funds from different Fed facilities (if necessary).

🗒Weekly Headline Summary

Asia-Specific

Singapore's Japan M&A tops annual record by April at $2.65bn

Rakuten Bank, Japan's top digital lender, surges in stock debut

Indian carrier Reliance Jio's profit, rev growth hit five-qtr low

Beyond Asia

Bitcoin ‘Halving’ Due Next Year Spurs Predictions of Rally in Token Past $50,000

Fed’s Next Rate Move May Crystallize With Coming Data: Eco Week

Hey mate, just wanted to say I love your work! Would you be interested in doing a cross-post together? Let me know!