2023 Week 3 -- "Shein" bright like a diamond

Shein experiences a 40% cuts to its valuation; Netflix's ad plan shows promise but there are a few factors investors should consider

💡 Did you know? In an effort to curb the impact of COVID on the economy, the fed printed $3 trillion, a fifth of all the US dollar in circulation that year!

Market Summary

Shein: Real-Time Fashion Pioneer

📝 Quick Recap

Shein (She In) is a real-time fashion startup focusing primarily on women’s clothing. Unlike other fast-fashion companies, which roll out new items every 3 weeks, Shein rolls out new items daily. Yes, daily!

Shein’s growth has been nothing short of spectacular. It has amassed > 43 million active customers and generated ~$16 billion in revenue (2021). As of April 2022, Shein was valued at $100 billion, making it one of the largest startups globally.

However, following a bearish market sentiment, the firm’s valuation has dropped to $64 billion. This decline has not deterred Shein’s plan to IPO this year.

🤓 Analyze like a consultant

I will not analyze whether Shein is “appropriately valued.” I will leave this task to the bankers. Instead, in this section, I want to highlight Shein’s ground-breaking business model and why the firm is in a strong position to win in the fast-fashion space.

To succeed in the fast fashion industry, players need to excel across 4 crucial aspects:

Have the best prices in the market— fast fashion has a mass market appeal where prices are key purchasing criteria

Provide a wide range of trendy fashion items — capitalize on the latest fashion trends and incentivize customers to frequently visit the online/offline store by offering a wide variety of products

Forecast demand accurately to reduce inventory — this helps reduce the risk of holding unwanted items in your inventory, which will only add to your costs.

Effectively acquire and retain customers — create hype around your brand to boost brand awareness and repeat purchases.

Shein outperforms in all these dimensions.

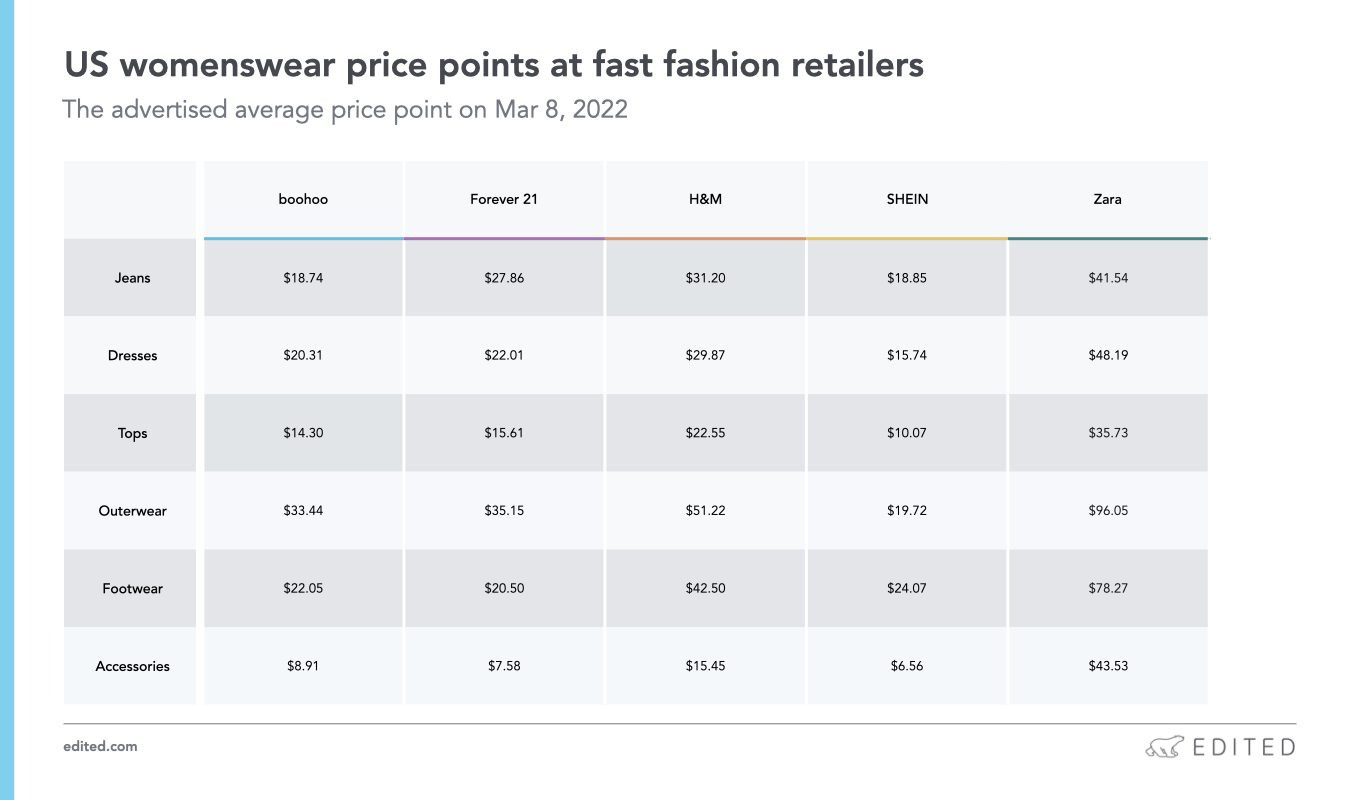

Extremely low prices: Shein does not sell in China. Instead, Shein leverages production in China to sell items overseas at low prices, undercutting its competition.

Shein does not even produce most of the items listed on its platform. It outsources production to suppliers that scramble to offer the lowest prices to lock in demand from Shein. Why?

Shein has the demand to negotiate aggressively with suppliers, allowing the firm to continue offering products at the lowest prices while preventing costs from spiraling out of control.

Additionally, Shein, unlike Zara, H&M, and Uniqlo, is completely online, selling products online across 220 countries and eliminating the high costs associated with physical stores (e.g., rent, logistics, and salaries).

Surprisingly, the low prices are not Shein's key competitive advantage. Actually, it is Shein’s ability to forecast demand effectively and adjust production accordingly.

Take the concept of A/B testing and magnify it by 1000 times. That's Shein.

In addition to analyzing in-app customer behavior, Shein utilizes algorithms to analyze the latest fashion trends on Google, social media platforms, and competitors' websites. Shein's team of 800 designers then designs apparel that reflects these trends — apparels move from the design to the production stage in 2-3 days versus three weeks industry standard. This way, Shein manages to be on top of the latest fashion trends and be a first mover to capitalize on these opportunities.

But, the firm does not immediately start producing thousands of products. Instead, Shein directs suppliers to produce small batches (50-100 items) for a particular product, testing the demand for these items. If the product successfully generates enough interest, Shein ramps up production. This way, Shein reduces unwanted inventory and focuses on selling clothing items that move fast. Simply genius!

More importantly, everything I have mentioned so far happens in real-time -- Shein's proprietary enterprise resource planning (ERP) software connects the front end to the back end of the business. In other words, the software analyzes consumer activity (e.g., items added to the cart, product searches on the Shein app, etc.) for the newly listed products and automatically updates production volume for suppliers, removing inefficiencies in the supply chain.

Effectively acquiring and retaining customers: Acquiring customers, especially in the fashion industry, is an outcome of hype. Shein has gained virality on TikTok, becoming one of the most followed brands on the platform (5.9 million followers) with over 8 billion views on its content.

How has Shein achieved this virality?

The firm heavily relies on key opinion leaders (e.g., micro-influencers) to boost brand awareness. Thanks to its low-cost base, Shein can provide above-market commission rates (10-20%) to these influencers, enabling Shein to acquire them easily compared to its competitors.

Additionally, Shein has gamified its user experience -- providing points for daily logins and sharing high-quality reviews (similar to Shopee) -- to boost its retention. For instance, ~38% of Shein's website traffic is through direct access, indicating that many customers are returning to purchase their next cheap, trendy clothing item.

What should investors look out for ahead of the firm’s IPO:

How will Temu’s (under Pinduoduo) entrance into the foreign markets affect Shein’s ability to grow in these markets? Both Shein and Temu rely on production in China to compete on prices, so can we expect a potential price war in short to medium term?

Logistics is still an issue, as Shein has little oversight over this process. In the world of next-day delivery, it will be crucial to observe how Shein increases the speed of delivery.

Shein has an amazing business model. Is it possible for the firm to venture into adjacent businesses (e.g., house furnishing) with large ticket items? This way, the firm could boost revenues while undercutting the competition in terms of prices.

What about the ethical concerns surrounding fast fashion — from high wastage to allegations of using child labor? How will the firm move towards a sustainable model? Is it even possible without fundamentally changing Shein's entire operating model?

Netflix’s Earnings Reflection

📝 Quick Recap

Netflix posted its earnings last Thursday:

The firm added 7.5 million new subscribers compared to its 4.5 projected figure for the quarter — great news!

Revenue for the quarter was $7.8 billion, which was in line with analyst expectations. However, earnings came in lower than expected due to one-off losses from euro-denominated debt.

CEO and Founder of Netflix, Reed Hastings, will be stepping down from his position.

🤓Analyze like a consultant

From aggressive price cuts to large investments in content production, competition in the streaming space has intensified in recent years. Following this fierce period of growth, streaming giants are now eyeing a more profitable way to grow.

Netflix, for instance, has launched an ad and an account-sharing plan to improve its revenue without substantially raising its costs.

Naturally, two important questions arise:

Is Netflix’s attempt to grow profitably promising?

What other factors should we look out for?

Is it promising? Netflix has experienced “very little” switching from premium plans to its newly launched ad plan. In other words, Netflix’s ad plan is not cannibalizing revenues from its more premium plans — amazing news!

Other factors to consider:

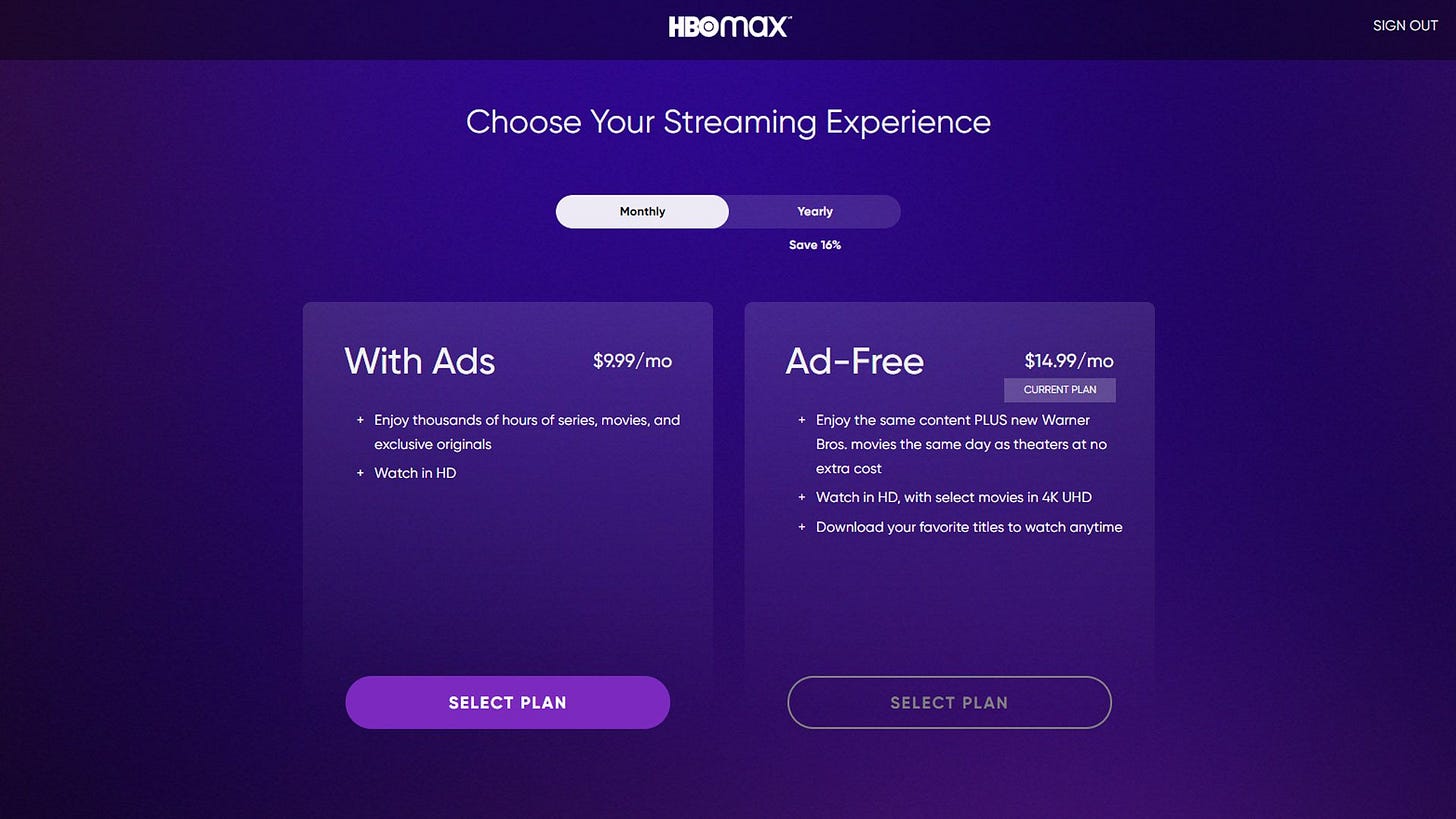

Competition in ad plans will heat up: Since customers in the ad plan segment actively seek the best value for their money, the platform with the lowest prices is best positioned to attract many customers. Hence, there is a possibility that prices will experience downward pressure as the competition heats up (e.g., Disney +, and HBO have launched their ad plans), negatively impacting revenue per customer.

If competition does heat up, then Netflix, when compared to giants such as Amazon, does not have the cash balance to sustain a prolonged price war, which could potentially hinder Netflix’s ability to scale its ad-based plans.

Additionally, by pricing its ads plans at $6.99 versus its $9.99 standard plan, Netflix intends to make up for the $3 difference via ad revenues from marketers. That’s a difficult task, considering advertisers have a lot of alternatives to Netlfix — other streaming platforms, social media platforms, Google, etc.

Furthermore, we are not sure how well Netflix’s ads work — are advertisers making a good return on their investments? To evaluate this, we must closely monitor whether advertising revenues contribute substantially to Netflix’s revenues over time.

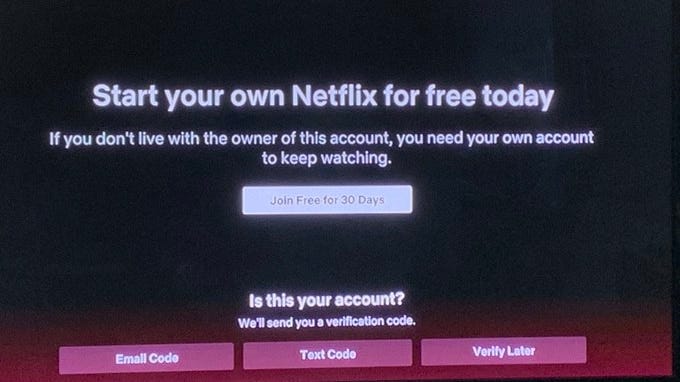

Churn from a crackdown on account sharing: Netflix is rolling out its paid sharing plan, where users pay an additional $2.99/month to share an account with someone from a different household. This way, Netflix monetizes from 100+ million subscribers who do not pay the full $9.99/month to view Netflix’s content.

If Netflix converts all 100 million users to its paid-sharing plan, it will generate ~$3.6 billion in revenue or a ~11% increase in revenue.

The only issue is how many users will stop using Netflix entirely. More importantly, if users are not willing to pay an additional $2.99, would the account owner also stop using Netflix?

Netflix’s bundled offering: In my previous article, I talked extensively about the importance of providing bundled service offerings to win in the streaming market. Netflix is building its gaming segment, leveraging its IP to create games that will help drive user engagement on its platform.

But Netflix still has a lot of factors to consider:

Subscription game pass is a competitive market: Netflix has created 50 mini-games. But to make gaming a long-term subscription strategy, Netflix needs to generate some big hits and a wide game repository, which will require heavy investments. Even with these investments, Netflix would need to compete with the likes of X box pass with much stronger gaming franchises.

Controlling distribution is key to win in the gaming market: Currently, all of Netflix’s games are accessible via its platform. But, if Netflix intends to make this a serious play, it must diversify its game distribution. The obvious issue here is that Netflix does not control distribution. In other words, Apple, Microsoft, and Sony will cut Netflix’s revenues if it pushes products via the App Store, PlayStation store, and other third-party platforms, negatively impacting revenues (App Store, for instance, charges a whopping 30% fee for app store purchases).

🗒Weekly Headline Summary

Asia-Specific

Grab tightens ASEAN food delivery grip despite slowing growth|NA

China reopening spurs record inflows into emerging market funds -BofA|RT

Japan Inflation Hits 4% to Keep BOJ Pivot Speculation Smoldering

Asia’s Richest Man Plans on IPOs for at Least Five Companies|BB

Beyond Asia

Google Parent Alphabet to Cut 12,000 Jobs Amid Wave of Tech Layoffs|WSJ

Musk’s Twitter Saw Revenue Drop 35% in Q4, Sharply Below Projections|TI

JPMorgan Model Shows Recession Odds Fall Sharply Across Markets|BB