2023 Week 6: Big Question Marks

Lyft shares plummet amidst weak 2023 guidance and disappointing earnings news; Affirm shares tank following an earnings miss

💡Did you know? During its primitive years, the Shell Oil Company sold seashells in London before venturing into the world of Oil & Gas.

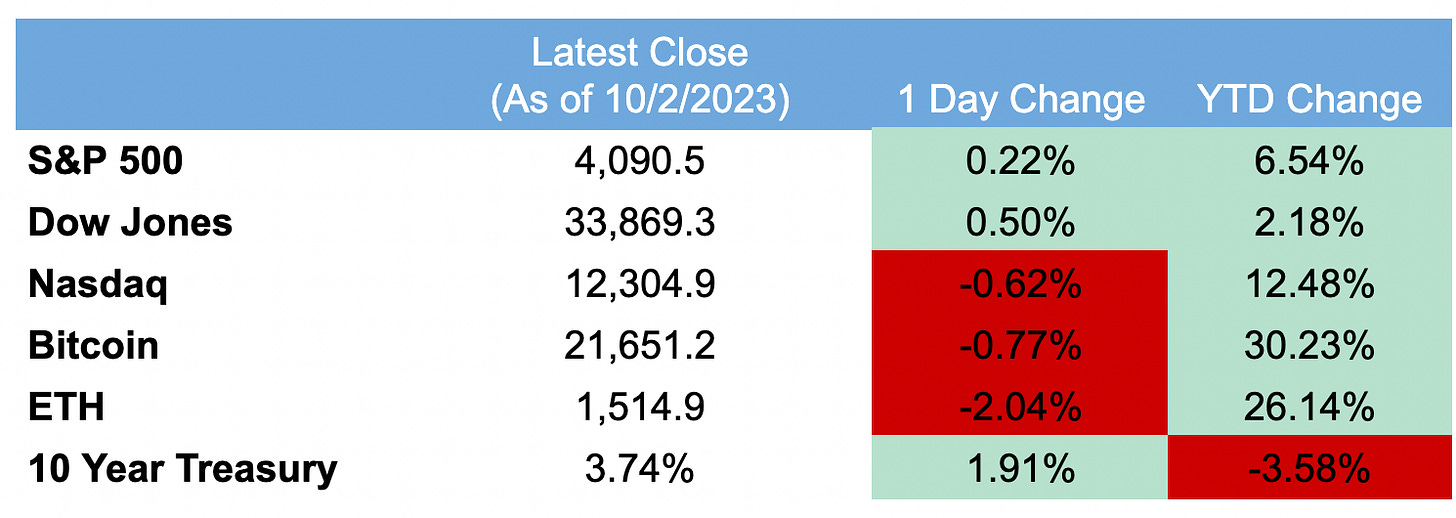

Markets Run Down

Ride-hailing: Is there a path toward profitability?

📝Quick Recap:

With disappointing earnings news, 2023 guidance, and management’s lack of coherent strategy toward profitability, Lyft’s stock price tanked 35% post-earnings release.

“Last night's Lyft call was a Top 3 worst call we have ever heard as in our opinion as management is trying to play darts blindfolded with the expense structure going forward and gave an EBITDA outlook which was a debacle for the ages.” — Wedbush Analyst

🤓Analyze like a consultant:

In light of Lyft’s disappointing earnings news, I want to briefly analyze how ride-hailing companies could achieve profitability (if such a feat is even possible).

Path to profitability hinges on reducing the fixed cost base

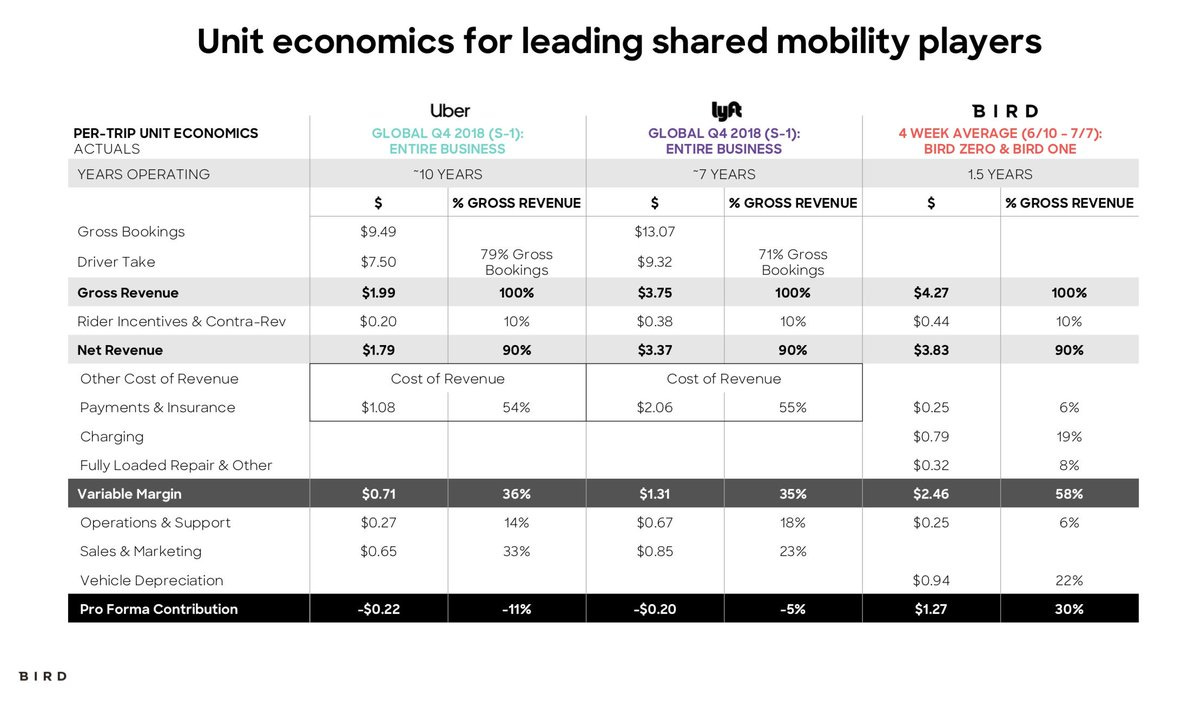

To understand this proposition, we need to dissect ride-hailing’s unit economics.

Ride-hailing business is notorious for its low margins — ~50-60% of the revenue is associated with variable costs, mainly in the form of insurance costs provided to drivers and riders. Then the question arises: Can we reduce variable costs to improve profitability?

There is limited opportunity to reduce variable costs unless ride-hailing companies venture completely into an insurance business model, providing insurance from their balance sheet. But, this move brings an additional set of complexities (e.g., how to underwrite insurance effectively and manage claims) that could further impact the ride-hailing companies’ operations and profitability.

Alternatively, firms could reduce drivers’ insurance costs by rolling out autonomous vehicles. Again, this move brings in additional expenses, such as vehicle purchase, maintenance, and repair costs, that would impact the bottom line.

Therefore, reducing variable costs without creating additional costs and operational complexity is extremely difficult.

Let’s explore other dimensions to reduce costs.

Reducing driver and rider incentives is possible if you are the sole player in the market:

Approximately 10-15% of revenues are provided to riders and drivers as incentives, allowing firms to secure a sufficient supply of drivers and consumer demand. Yes, there is room to reduce incentives in the future, but the question is to what extent?

As long as there is more than one ride-hailing player in the market, reducing incentives spending is difficult. Why?

Well, if your incentives are less competitive than the other players, drivers will flock to the other platform, meaning the wait times will be longer on your platform. Consequently, consumers will switch to other platforms, hurting the bottom line.

The only way to reduce incentives is when you are the sole player in the market, where the only alternative to your platform is getting a taxi by the side of the road. As we all know, calling a cab is a huge hassle, meaning the switching costs from a uber-like platform to no-platform is high. Hence, if you are the sole ride-hailing player in the market, you can reduce consumer incentives with minimal impact on your revenues. As for driver incentives, you don’t need to provide competitive rates in the market as there are no competitors, enabling you to reduce costs further.

As for the fixed cost base, Uber and Lyft both have SG&A and R&D costs that comprise 30-40% of their revenues, which is exceptionally high. Hence, these firms need to figure out where they can remove inefficiencies. For starters, they could explore how to make their marketing efforts more cost-efficient and their organization leaner.

Nevertheless, it is crucial to understand that reducing SG&A costs will not drastically push the profit margins into positive territory. Think about it. If Uber and Lyft cut SG&A costs by 10-15% (which is already quite difficult), it would only add 4-5% to the net profit margins — Uber would still be unprofitable, whereas Lyft would barely break even.

The question then arises: What else could ride-hailing firms do to achieve profitability?

Creating an AWS-like arm to boost profits

Most ride-hailing giants have ventured into the food delivery market. But, this move will not improve the unit economics of the overall business. Food delivery is a highly competitive market with extremely low margins, succumbing to the same profitability issues as the mobility segment (e.g., driver, restaurant and customer incentives, and high delivery costs).

So, where can these ride-hailing businesses venture next?

E-commerce? — not profitable at all (Amazon at scale is not profitable)

Courier delivery? — difficult to achieve profitability and requires heavy investments into logistics networks (e.g., warehouse, vans/trucks, etc.)

Digital banking? — highly competitive market, but ride-hailing service providers have an advantage over incumbents (users frequently use their apps for day-to-day activities, and these firms have better brand awareness than incumbents do).

Entering the digital banking space is one of the best bets for ride-hailing services to achieve profitability.

At scale, digital banks could earn up to 20-30% net profit margins (refer to TinkOff and Kakao Bank) vs. ride-hailing companies that still lose money at scale (e.g., Grab, Uber). So how could ride-hailing companies pivot to a digital banking model?

For starters, ride-hailing companies would need to start with simple e-wallet and debit card offerings, earning revenues primarily through fees. This way, ride-hailing companies can increase the frequency at which customers engage with their financial products.

Why is this important? Suppose the ride-hailing company wants to roll out other financial products in the future. In that case, it is easier to market the new products to customers who are already using your financial services daily and are heavily ingrained in your ecosystem.

After creating a high-frequency use case for their financial services, firms can venture into loans that provide higher revenue per user. The key to scaling interest-based income is having access to low-cost funds, which is possible by accepting customer deposits (via a digital bank license). Ride-hailing companies could expand into loan products that contribute positively to their ecosystem (e.g., SME loans to restaurants, personal loans to drivers, etc.) before expanding into more complicated loan products (e.g., mortgage and car loans).

The above ideas are a high-level overview of how ride-hailing companies could scale their digital banking model. Scaling a digital banking model has its challenges, but at scale, it would drastically improve the overall unit economics of ride-hailing businesses.

Affirm: Not So Affirming

📝Quick Recap:

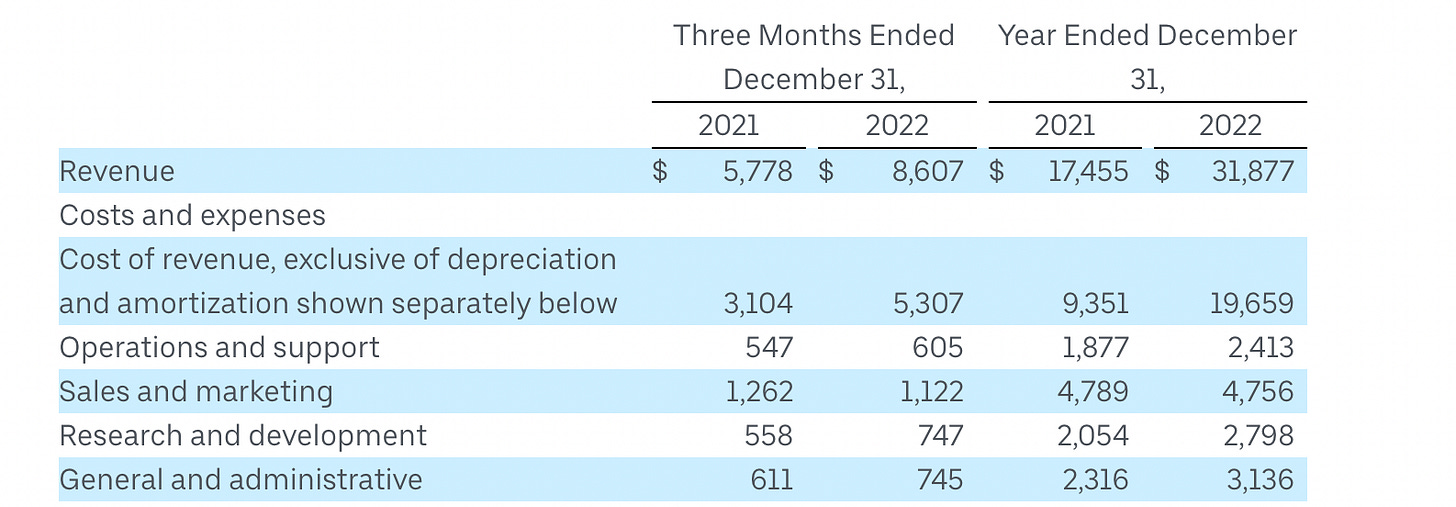

Affirm, one of the largest Buy-Now-Pay-Later (BNPL) companies, recently reported its earnings results. Affirm’s top and bottom lines missed analysts’ estimates, and the stock price tanked 22%. Affirm is now focused on cutting costs wherever possible, planning to lay off 19% of its workforce.

Why?

Fundamentally, BNPL players generate profits via the difference between the interest rates they charge to consumers, the cost of the funds lent out to consumers, and the loan default rates (Interest rate - Cost of Funds - Delinquency Rate).

As you may already notice, BNPL players’ cost base is susceptible to the broader economic climate. So it is not a surprise that the cost of funds (BNPL players need to borrow funds from banks and other lenders as they do not collect customer deposits) and the loan default rates have drastically increased recently, affecting Affirm’s profitability.

The path to profitability for BNPL providers looks bleak as their cost base is susceptible to market conditions. How can they overcome this issue?

Simple. Find cheaper alternatives to borrow funds. Accepting customer deposits is the best way to lower the cost of borrowing. This way, Affirm could payout of 1-3% in interest rates annually to customers on their deposits vs. 5-9% interest rates they currently borrow funds at.

At the same time, accepting customer deposits opens up a new business model for Affirm. They are not limited to just providing BNPL loans. With customer deposits, Affirm could diversify into more secured loan products, which would help it keep its delinquency rates low.

All these potential solutions point towards a specific direction: BNPL players will eventually converge into a digital banking model. I have commented extensively about this phenomenon in my Buy Now Pay Later (BNPL) — Path to Profitability article, where I explore why a standalone BNPL business model is not sustainable for the long term.

🗒Weekly Headline Summary

Asia-Specific

China e-commerce startup to open big box store for Japan, other imports|NK

Japan’s LDP Policy Head Says Monetary Policy Has Room for Reform|BB

China tightens requirements on classifying banks' asset risks|RT