Buy Now Pay Later (BNPL) — Path to Profitability

Standalone BNPL service providers need to diversify offerings beyond 0% APR loans to boost profitability and ensure survivability

In recent years, Buy Now Pay Later (BNPL) has become a popular payment method in the e-commerce space. Despite BNPL’s prominence, no profitable player has emerged globally in this space. Even players that support billions of dollars in gross merchandise value and have millions of customers are not profitable (e.g., Klarna, After Pay).

How can BNPL players achieve profitability? The question of profitability is especially important in today’s context of rising interest rates and the looming possibility of a recession, which are factors that would significantly hurt the fundamentals of a BNPL business.

To put forth a solution to the question above, I will examine three main strategies and evaluate each of their effectiveness:

Low hanging fruit

Diversification into interest-based BNPL loans

Diversification beyond BNPL loans into adjacent offerings (Digital Banking Model)

Low Hanging Fruit

1. Increasing merchant fees

BNPL players should focus on improving revenues from merchant fees as they comprise the bulk of BNPL operators’ revenues (e.g., Affirm receives ~50% of its revenues from merchant fees). To do so, BNPL players should strategically target merchants in high-margin sectors with high customer acquisition costs, charging higher fees (as a percentage of order value) to these merchants.

Merchants with a high customer acquisition cost have a higher incentive to onboard BNPL services to lower marketing costs, which is a major cost component for merchants. With its 0% interest charged to customers, BNPL operators are essentially running promotions for merchants, enabling them to acquire customers easily.

Additionally, merchants with high margins have room to absorb the merchant fees that BNPL providers charge. If merchants with low margins are onboarded, any effort to increase merchant fees would negatively affect revenues as these price-sensitive merchants would opt out of the BNPL provider’s network.

Hence, merchants with high user acquisition costs and high margins (e.g., luxury retailers, medical – refer to Figure 1) are BNPL providers’ ideal customers.

2. Increasing average order value

BNPL players earn revenues from merchants in the following way: merchant fee x order value. A starting point to boost average order value would be to target luxury retail and medical sectors, where the average ticket size is generally larger (refer to bubble size in Figure 1). Some players, such as Splitit and Open Pay, are already implementing this strategy by targetting luxury jewelry and home improvement segments in an effort to improve margins.

3. Increasing access to merchant networks and diversifying business concentration risk

Increasing the merchant network effectively is a critical success factor in improving BNPL providers’ top-line. BNPL players should strike exclusive partnerships with e-commerce marketplaces to power BNPL transactions, allowing BNPL providers to simultaneously ward off competitors and gain access to a large merchant base. For instance, Affirm has struck an exclusive partnership with Shopify to power BNPL services for >100,000 merchants in an effort to lower its merchant acquisition costs. With a vast merchant network, BNPL providers also lower the risk of heavily relying on a handful of merchants to drive revenues.

4. Limitations

The room to improve merchant fees is limited if no exclusive partnership is struck with merchants. To elaborate, merchants already offer multiple BNPL options at checkout to ensure they are servicing customers from different providers. If one BNPL provider charges substantially higher fees than the rest, then there is a high possibility that merchants will discontinue their services with that BNPL provider. Hence, the merchant fees BNPL providers can realistically charge depend on their competitors’ pricing strategies.

Focusing on large ticket item purchases seems appealing financially, but it reduces the frequency customers use a provider’s service. Let’s think about this a bit more. How often would a credit-constrained individual buy item worth more than $1000 per year? Maybe once or twice a year. However, the number of times customers interact with a BNPL offering enables the provider to build a sticky customer base and grow brand awareness, two crucial factors for scaling a successful BNPL service. In fact, After Pay started off providing BNPL for cosmetics products due to the high purchase frequency, enabling the company to scale rapidly via word of mouth. Hence, there must be a portfolio balance between large and small ticket items to consistently engage with customers and build brand awareness.

Apart from the drawbacks of the abovementioned strategies, rising interest rates could further worsen matters for BNPL players. Rising interest rates would increase the cost of funds while also increasing delinquency rates as buyers fail to meet payments in a recessionary environment. As a result, bottom-line margins (as a % of GMV) would plunge further into the negative territory.

With a rising cost base and limited revenue uplift from merchant fees, I am pessimistic about the path to profitability for these standalone BNPL providers. Hence, a strategy to boost revenues while maintaining the cost base is crucial to increase profitability, which will be discussed in the next section.

Diversification into interest-based BNPL products

BNPL companies should extend beyond 0% APR loans into charging interest rates for longer-duration loans (e.g., loans that span over a few months). Given the unsecured nature of BNPL loans, firms can charge high APRs (10-40%), uplifting revenues beyond merchant fees. This strategy is not novel. Leading BNPL operators are shifting their portfolios toward interest-bearing loans. For instance, ~58% of Affirm's portfolio consists of interest-bearing loans compared to ~42% of 0% interest loans (figures as of 2020). There is a good reason for this.

1. Interest income provides an opportunity to uplift revenues.

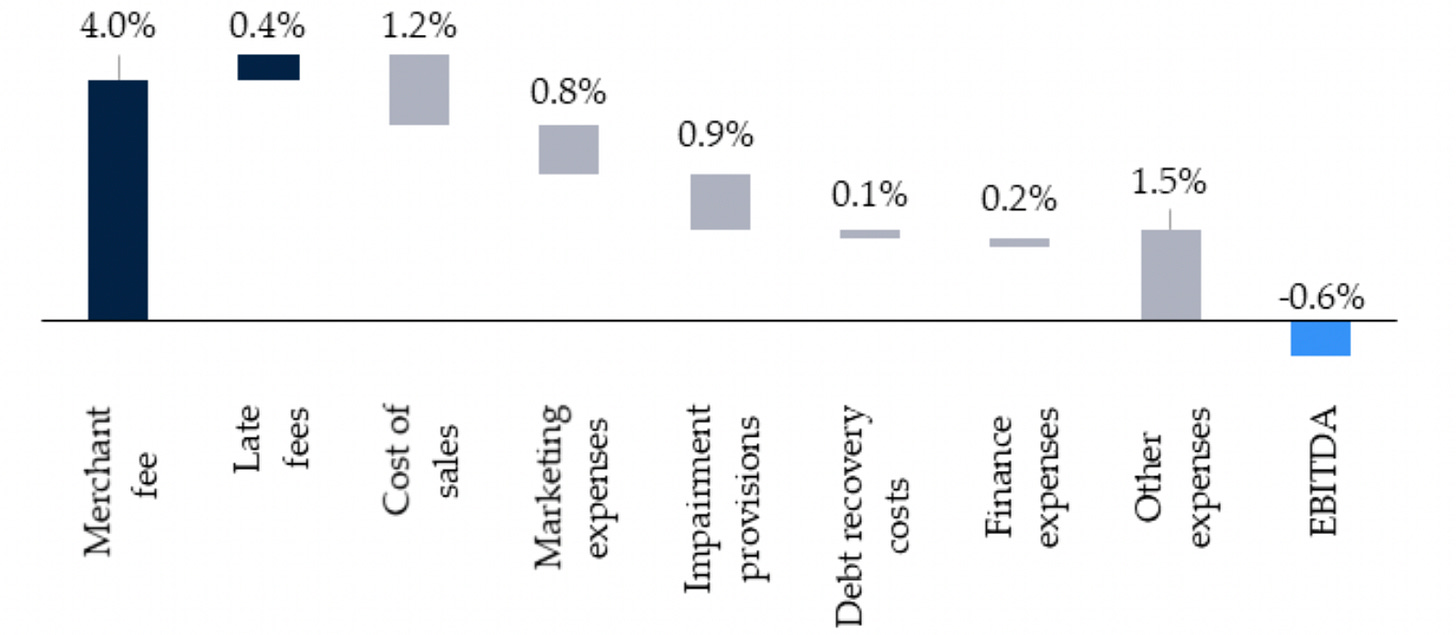

Let’s look into Affirm again. Affirm generated ~4.6% of GMV from merchant fees. But, with interest income, Affirm significantly improved its revenues, uplifting revenues to ~8-9% of its GMV. That is a ~4% uplift in revenues (as % of GMV) than just solely relying on merchant fees!

Contribution margins (revenue minus transaction costs) also improve as BNPL operators diversify into interest-bearing BNPL loans. Affirm generated a positive contribution margin of ~5% (refer to Figure 2A). This contribution margin is larger than BNPL providers that solely rely on merchant fees (e.g., After Pay only generated 2% in contribution margin; refer to Figure 2B). With a larger positive contribution margin, BNPL providers that charge interest would have a relatively easier path to profitability than standalone BNPL providers.

2. Selling interest-bearing loans to improve revenue and offload risk

Holding BNPL loans on the balance sheet also opens up another avenue for revenue generation. BNPL firms have the opportunity to sell loans to NBFI partners to profit from loan sales and offload risks. For example, Affirm sells its longer-tenure loans to partner institutions generating approximately 1% of its GMV via this channel. However, it is also important to note that Affrim's loss on loan sales is higher than its gain on sale from the loan (refer to Figure 2A). I don't foresee this as a significant issue in the years to come as BNPL operators develop expertise in pricing and selling loans at a profit.

Limitations

Nevertheless, the positive contribution margins are still insufficient to cover the high fixed cost base of the BNPL players. For example, Affirm's fixed cost base comprises ~8% of its GMV compared to its ~ 5% contribution margin. From my perspective, BNPL players have two options to move forward to generate profits:

1) Reduce fixed cost base

2) Improve contribution margin (Revenue minus transaction costs).

In this article, I will not focus on how players could reduce the fixed cost base, which requires proprietary data to conduct thorough cost analyses. Instead, I would delve more into the second point about improving contribution margins.

Diversification beyond BNPL loans into adjacent offerings (Digital Banking Model)

BNPL players could boost their contribution margins in a couple of ways: reduce the cost of funds and default rates or increase revenues.

However, there is a way for BNPL players to concurrently reduce costs and increase revenues – transitioning into a digital-bank business model.

In my view, transitioning from a standalone BNPL business model into a full-fledged digital banking model is natural. Ensuring high user engagement and a sticky customer base is critical for a BNPL operator to succeed, and a move toward digital banking enables these firms to achieve just that. BNPL players, such as Affirm and Klarna, have already transitioned into providing essential digital banking services (deposits and debit cards), utilizing BNPL product offerings as a low-cost customer acquisition channel for their broader digital banking services. In the long term, I believe that standalone BNPL players would converge into providing digital banking services as the unit economics of a standalone BNPL model deteriorates.

Going back to the topic of improving profitability. I believe that a digital banking model would improve BNPL operators’ contribution margins in the following manner:

The digital banking model helps reduce the cost of funds: BNPL players borrow capital from banks to extend BNPL loans to customers. Given these firms' relatively higher credit risk ratios than firms that offer secured-lending products, BNPL players have a lower credit rating. As a result, the interest rates at which BNPL operators borrow loans from their bank partners are also higher, increasing their cost of funds. However, with a digital banking model, BNPL operators can access funds from customers via checking and saving account deposits. BNPL operators now have the opportunity to borrow funds from customers by providing them 2-3% on their checking and savings accounts annually versus the high rates they pay banks.

Data benefits to enhance credit decisions: With a digital banking model, BNPL providers have the opportunity to collect data regarding various customer behaviors (e.g., spending analytics, spending behavior). In doing so, BNPL operators could improve their customer credit checks and provide personalized loan prices based on the customers’ risk profile. With these, BNPL operators can realize lower delinquency rates over time as their internal credit scoring model is dynamically trained with increasing data points.

Significant room for revenue uplift: The exciting aspect of a digital banking model is its diverse revenue uplift opportunities. Leading digital banking firms such as WeBank and Kakao Bank offer a diverse range of loan products (e.g., mortgage, SME loans) and products beyond loans (e.g., stock brokerage, debit card). As a digital bank, BNPL operators have the opportunity to capitalize on these different revenue streams and improve their unit economics over time.

In the short term, I foresee BNPL operators providing basic banking service offerings, such as deposits, P2P transfers, and debit cards, to build their digital banking foundations. This transition has already started. For example, Affirm has launched a virtual debit card and created a checking/saving deposit feature for its customers. Affirm has generated some revenue from its debit card feature via interchange fees that account for ~0.6% of its GMV. These figures do not shift the needle in terms of revenue uplift, but we must be aware that Affirm has just recently built up this feature. There is still significant room for growth. To illustrate, Nu Bank, a leading Brazilian digital bank, gets approximately 30% of its revenues through interchange fees, indicating the potential room for revenue uplift BNPL operators could witness.

In the medium to long term, BNPL players would eventually move into adjacent product offerings (e.g., personal loans, mortgage loans, SME loans) and cross-sell these products to end consumers. The cross-selling aspect of a digital banking model is fascinating as it would enable BNPL operators (or emerging digital banking players) to build a sticky customer base. For instance, customers who have been with Kakao Bank for five years use six Kakao Bank products, and the number of products customers use is directly correlated with the amount of time they have been with Kakao Bank (refer to Figure 3). Cross-selling products would enable BNPL operators to increase revenues while lowering customer acquisition costs as they push different products to their existing customer base. In doing so, BNPL players can improve contributing margins while limiting their fixed costs (e.g., marketing costs), boosting profitability over time.

Conclusion

With rising interest rates, standalone BNPL operators must rethink their strategy to achieve profitability. BNPL firms should first diversify into launching interest-based BNPL loans for larger ticket items to uplift revenues. However, in the long term, operators should consider transitioning into a digital banking model, reducing the cost of funds with low-cost customer deposits and improving revenues by cross-selling different products beyond BNPL loans.