2023 Week 10: A Wild Ride

Silicon Valley Bank collapses, SEA reports first ever profit, Fed to increase rates further

💡Did you know? Elon Musk was not the original founder of Telsa. In fact, he was the lead Series A investor for Tesla, becoming the chairman of the board in 2004. It was not until 2008 that Elon stepped into the CEO role after ousting Eberhard, the original founder of Tesla.

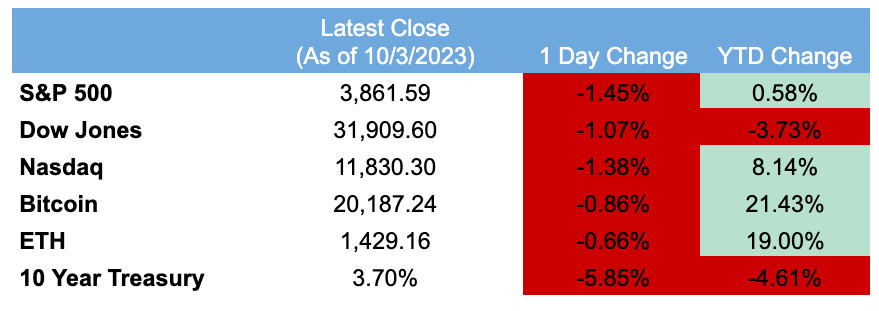

📈 Markets Rundown:

Silicon Valley Bank: Largest bank failure since the Global Financial Crisis

📝Quick Recap:

Silicon Valley Bank, the 16th largest bank in the US and the largest bank in Silicon Valley, collapsed in under 48 hours.

What caused SVB’s decline?

Before answering this question, let’s understand how banks function fundamentally. They take customer deposits and use them for lending and investing purposes.

As you may already notice, banks can face problems on two fronts:

1) When their assets (e.g., investments, loans) value declines rapidly

2) When many depositors remove funds simultaneously, aka bank run.

In the context of SVB, the bank’s problems started when its investments’ value declined rapidly. Why? Well, SVB invested in US treasuries when interest rates were low. But over the past year, when the Fed increased interest rates to combat inflation, these bond investments suffered a massive blow — the price of bonds and interest rates are inversely correlated.

Nevertheless, SVB was still sitting on unrealized losses. In other words, the bank would only lose money once it has finally sold the bonds, hence, realizing the losses. So what happened?

As you may recall, 2022 was not a great year for startups. Tech valuations were taking a massive hit, making it difficult for silicon valley-based startups to raise funds. As a result, these startups withdrew their funds from SVB to fund their operations, which sparked the onset of problems for SVB.

To facilitate the withdrawal of deposits, SVB was unable it sell its long-term investments. Even if it was able to, the bank had to sell investments at a massive loss. The situation deteriorated to the extent that SVB had to raise $2.25 billion via equity sale to support these withdrawals. This dire situation led to widespread fear amongst startups, who then rushed to withdraw all their funds from the bank. In fact, the total amount of withdrawals came up to $42 billion! Ultimately, this bank run resulted in the collapse of SVB.

“Everyone on Wall Street knew that the Fed’s rate-hiking campaign would eventually break something, and right now that is taking down small banks” — BBC

What’s next?

Financial regulators have closed SVB and seized its assets. Now, the question is whether the depositors who did not remove their funds in time would receive their money back.

Federal Deposit Insurance Corp. (FDIC) mentioned that insured depositors would receive up to $250,000. Whether the depositors with more than $250,000 will get all their money back depends on how much funds regulators can retrieve by selling the bank’s assets.

As for uninsured depositors (comprise 87% of depositors), they will get receivership certificates for their balances, allowing them to receive dividend payments once the regulators sell the bank’s assets.

SEA: Achieves profitability for the first time

📝Quick Recap:

SEA reported its first profitable quarter, positive news for the company that has been struggling to turn positive since its inception. As a result, SEA group’s shares jumped by 21%, indicating excitement amongst investors.

What was the main driver behind the positive news?

SEA, like other tech firms, focused on cutting costs wherever possible, beginning with employee and marketing expenses. For instance, SEA cut more than 7000 jobs over the past year and focused on more targeted investments across shipping incentives and brand marketing. As a result, its sales and marketing costs, a major cost bucket, were down 55% year-on-year in the fourth quarter, allowing the firm to enter the positive territory.

Fed increasing rates again!

📝Quick Recap:

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated” — Jerome Powell

Inflation, based on January data, did not show signs of slowing down. In fact, inflation rose in January by 0.5% despite Fed’s attempt to curb rising prices. Following these results, the fed has indicated that it would increase interest rates and the pace of interest rate hikes this year.

In December, the Fed pegged the terminal federal funds rate at 5.1%, but the market estimates the rate to be in the range of 5.5 - 5.75%. In other words, we can expect a further slowdown in economic activity as lending and investing become increasingly more expensive.

🗒Weekly Headline Summary

Asia

India's industrial output grows 5.2% year/year in January|RT

Chinese bank earnings threatened by early mortgage payments|NK

Roku Among Most-Exposed Firms With Assets Caught in SVB Failure|BB

Beyond Asia

A $13 Billion Plunge in Bond Sales Hints at Pain for EM Credit|BB

Saudi Aramco Posts Blowout Annual Profit and Raises Dividend|BB

Tech execs race to save startups from 'extinction' after SVB collapse|RT