Netflix: In Need of a Strategic Pivot

Netflix needs to diversify its revenues beyond video streaming to improve its free cash flow and ensure its long-term sustainability

Through its plethora of media libraries, Netflix has radically altered how we consume digital media by mainstreaming binge-watching culture. However, binge-watching culture is Netflix’s double-edged sword.

On one hand, it has helped Netflix attract and retain consumers, gluing them to Netflix’s content for 3.2 hours/day (on average). On the other, subscribers expect a high frequency of new, high-quality content, pressuring Netflix to curate new media and produce original content consistently. To put things into perspective, “Netflix gives users $1.5 billion of content for every dollar a month they pay”, which is not a sustainable long-term strategy.

Netflix’s core problem revolves around improving its free cash flow. Its content investment has outpaced revenue growth. Hence, in this article, I explore potential strategies Netflix could pursue to successfully expand its customers while growing its free cash flow in the long term.

I segment the article into 3 main sections to help us uncover potential solutions to Netflix’s problems:

What strategies is Netflix pursuing to prevent subscriber loss? Are they effective?

What are Netflix’s competitors doing to grow in the streaming space and what can Netlflix learn from them?

Ultimately, what could Netflix pursue to maintain its market share and grow sustainably in the future?

How is Netflix responding to subscriber losses?

Ad-based Subscription Plan

Netflix has rolled out an ad-based subscription plan, allowing it to monetize from customers who would have avoided Netflix for a competitor. I believe this strategy is a short-term fix to Netflix’s low subscriber growth, but I do not consider it a deal-breaker for Netflix's free cash flow problem.

An ad-based subscription plan is not a novel concept. Spotify has popularized this business model and has leveraged its ad-based plans to enter LatAm and APAC markets. I expect Netflix to follow a similar growth story.

The ad-based plan is an effective go-to-market strategy in emerging markets with more price-sensitive customers, but the strategy has its challenges:

Netflix would succumb to the same problems Spotify currently faces — converting ad-users into premium ones. For instance, 46% (as of 2022) of Spotify’s monthly active users (MAUs) are from APAC and LatAm regions, increasing from 33% in 2018. Still, the percentage of premium subscribers from these regions has not witnessed the same growth. APAC and LatAm regions only comprise 33% (as of 2022) of total premium subscriptions vs. 29% (as of 2018). Premium subscription is where the margins are and a failure for Netflix to convert ad-users into premium ones would not drastically improve Netflix’s profitability in the long term.

Ad-based revenue would not substantially increase Netflix’s overall revenue. For instance, Spotify, after years of execution, has expanded its ad-based revenue to comprise only 13% of its total revenue (as of 2022) vs 10% in 2018.

Making matters worse, other video streaming platforms (e.g. HBO GO, Disney+) are also launching ad-based plans, further putting competitive pressure on Ad-based subscription prices. Since the customers in this segment actively seek the best value for their money, the platform with the lowest prices would attract a bulk of the customers. Netflix, compared to giants such as Amazon and Disney, does not have the cash balance to provide the most attractive ad-based subscription prices in the market, hindering its ability to succeed from its ad-based subscription model.

Account Sharing Crackdown

Netflix currently has 100+ Million subscribers that it does not monetize from. A crackdown on password sharing is a logical step toward extracting more value per user. To do so, Netflix intends to add an “add a home” feature that would charge users an additional $2.99 to allow someone from a different household to share an account.

However, I believe that Netflix should tread lightly here as it could lose some of its paid subscribers as opposed to monetizing from unpaid ones.

Let’s think about a scenario. John shares his Netflix password with Jack, and they split the monthly subscription. With the “add a home” feature, Netflix’s subscription plan, which is already more expensive than its competitors’ plans, would become even more costly. Given the rise in alternate streaming platforms, there is a possibility that both Jack and John would discontinue their subscription plan with Netflix. Making matters worse, if a Netflix account is shared with more than 2 people then adding additional households would become increasingly more expensive, increasing the churn rate for paid users.

The scenarios I have just described are not uncommon. I think almost everyone I have encountered who watches Netflix shares an account with someone outside his/her household. Therefore, to truly judge this strategy’s effectiveness, we need to closely monitor the net subscriber gains Netflix achieves as it cracks down on password sharing next year. Though I am not optimistic about the outcome of this strategy.

How are Netflix’s competitors gaining market share and what can Netflix learn from them?

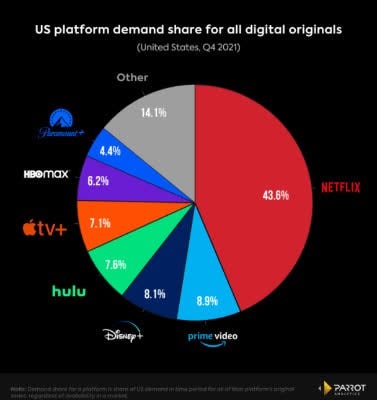

Noticing Netflix’s success, Amazon, Disney, and Apple entered the streaming space over the past two years, rapidly taking market share away from Netflix. Their success stems can be attributed to two major factors:

Attractive Bundles

Apple and Amazon have successfully built an ecosystem that allows them to cross-sell their products, and have leveraged cross-selling strategy to gain market share in the streaming space. For instance, Amazon bundles Amazon Music, Prime, Gaming, and Prime Video for $14.99/month. Similarly, Apple has launched its Apple One bundle, packaging Music, Arcade, Cloud, and TV+ for $14.95. These tech giants have effectively created a value bundle to attract and retain users across emerging and developed markets.

Unfortunately, Netflix cannot bundle any service, relying solely on its content quality to attract and retain subscribers. While this strategy has worked for Netflix in the last decade, I believe that the market dynamics in the streaming space have altered significantly, rendering a complete reliance on content quality to be unsustainable in the long term.

Large Cash Balance to Fuel Growth

Amazon, Disney, and Apple have large cash balances allowing them to outlast Netflix in content investments and marketing. Producing original content that turns into blockbusters is a numbers game — if you make enough investments, 1 or 2 shows would become massive hits. For instance, we already are seeing Amazon building its original content repository (e.g. The Boys) which is gaining massive traction. As these tech giants continue to pump money into content investments, Netflix’s competitive advantage in producing original hits would continue to diminish.

Strategies for Netflix’s Long-Term Survival

As mentioned previously, Netflix’s core problem revolves around improving its free cash flow. Currently, Netflix has a large fixed cost base due to recurring fees it pays to third-party movie/tv show providers coupled with large investments into original content production. Netflix cannot substantially cut its fixed costs to grow its free cash flow since Netflix’s main selling point is its large third-party and original content library.

To work around this, Netflix needs an avenue to add customers without substantially increasing its fixed costs and capital expenditure. In other words, it needs to diversify its revenues beyond video streaming. Currently, Netflix is rolling out its gaming service, but gaining substantial traction in an already competitive gaming market requires significant recurring investments. Alternatively, acquisitions and/or partnerships are a more feasible strategy to improve free cash flow in the long term.

Acquiring Spotify

Spotify is an attractive acquisition target with a $17 billion valuation (down from $46 billion on December 31st, 2021). With Spotify, Netflix could realize significant revenue and cost synergies that would enable the combined entity to improve its free cash flow in the long run.

Revenue Synergies:

Cross-selling in emerging markets: Netflix has the opportunity to cross-sell its subscription plan to Spotify users in LatAm and APAC markets, accelerating growth in these regions. As of Q2 2022, Spotify has 199 million monthly active users from LatAm and APAC, while Netflix only has 74 million users. Even if we assume 100% overlap in customer base, Netflix still has room to acquire 125 additional million users. At the same time, Netflix would have the opportunity to cross-sell Spotify’s subscription plan to its existing customer base to further extract additional value per customer.

Attractive bundle to easily acquire users: A main customer pain point is the cost of using different music and video streaming service providers. Moreover, acquiring customers as a standalone video streaming service provider in a market where competitors are providing value music and video bundles is increasingly becoming a difficult task. With Spotify, Netflix has the opportunity to kill two birds with one stone, allowing the merged firm to acquire customers more effectively than as a stand-alone video streaming provider.

Podcast growth engine: Spotify has acquired production houses to create original podcast series and has actively curated podcasts from creators, emerging as one of the top destinations for podcast listeners. As podcast continues to gain popularity, Netflix has additional room for revenue growth. Moreover, producing podcasts, on a per-episode basis, is substantially cheaper than creating original TV shows and movies, allowing Netflix to grow its revenue while relatively reducing content investment costs.

Increasing value extracted per user in developed markets: Spotify and Netflix have a high customer overlap in developed markets (NA and Europe). With a bundled offering, Netflix could successfully increase average revenue per user (ARPU) while reducing subscriber churn in developed markets — Netflix lost 1.3 million subscribers (as of Q2 2022) in US and Canada when it increased its subscription prices earlier this year. A bundled offering provides an additional incentive for customers to stay with Netflix and extract a higher value per customer than it would have with Netflix as a stand-alone service.

Cost Synergies:

Bargaining power: With a combined user base of ~400 million users, Netflix could gain leverage in negotiating contracts with movie and music labels, reducing fees paid to third parties.

Capabilities Synergies:

Data Analytics: Netflix would have access to more data points across different products to improve its recommendation algorithm. In doing so, Netflix can strengthen content personalization, allowing it to increase customer stickiness on its platform

Content Synergy: Netflix would have the opportunity to create music playlists for its original content, providing another avenue for fans to engage with Netflix’s content. As a result, Netflix could strengthen retention as it builds additional hours users engage with its content.

A partnership with Microsoft

Netflix has curated excellent local content for audiences in LatAm and APAC markets —miles better than what Apple, Amazon, and Disney have achieved so far. Despite this, Netflix has not achieved incredible growth in these regions. Netflix needs a catalyst to realize exponential growth and I believe a partnership with Microsoft could be that spark.

X-box pass has been a massive success, amassing 25 million subscribers in 2022 vs 18 million in 2021 and expanding its game portfolio from 100 to 450 games. X-box pass does not have a subscriber count that would shift the needle for Netflix, but X-box, as one of the first movers, is well-positioned to grow within the cloud gaming market.

Cloud gaming, though nascent, is radically changing the way games are consumed. Users are no longer limited to owning a PC or a gaming console to play games that were previously limited to these platforms. This is especially great for emerging markets, where games previously reserved for consoles and PCs could be accessed from low-cost mobile phones at affordable prices. We are already seeing the effects of this — the APAC region is the fastest-growing market within the cloud-gaming segment.

For Netflix, the cloud game boom is a great cross-selling opportunity for the millions of gamers within the growing APAC and LatAm markets in the long term. Moreover, this cross-selling opportunity does not require additional investment on Netflix’s end. Netflix can acquire additional users while maintaining the same fixed cost base, allowing it to spread its costs across a larger user base and creating a lucrative opportunity to boost free cash flow.

Conclusion

I would continue to monitor Netflix’s ad-based subscription plan rollout. I have highlighted my doubts about the long-term sustainability of this strategy, mainly revolving around converting ad users into premium ones and how Netflix would navigate around the competitive ad-based subscription prices. To respond to its competitors effectively, Netflix needs to bolster its services through acquisitions or partnerships — Microsoft and Spotify are my top picks. Unless a long-term pivot into gaming or music streaming markets is executed, I am still pessimistic about Netflix’s long-term sustainability from a free cash flow perspective.

Tejas very insightful and thoughtful piece. Looking forward to reading more from you .