2023 Week 8: It Does Not Look Good

Coinbase revenue dried up; Walmart earnings reflect broader consumer purchasing behavior; inflation is here to stay

💡Did you know? Prior to its demise, the Soviet Union traded 20 warships in exchange for carbonated drink shipments from Pepsi. This trade made Pepsi the owner of the sixth-largest navy on the planet.

📈Market rundown

Coinbase: Feeling the pain from crypto winter

📝Quick Recap:

Coinbase's revenue plummeted by 75% in 2022 vs. 2021. Following this devastating news, the firm’s stock price has dropped by ~7%.

What caused this massive decline in revenue?

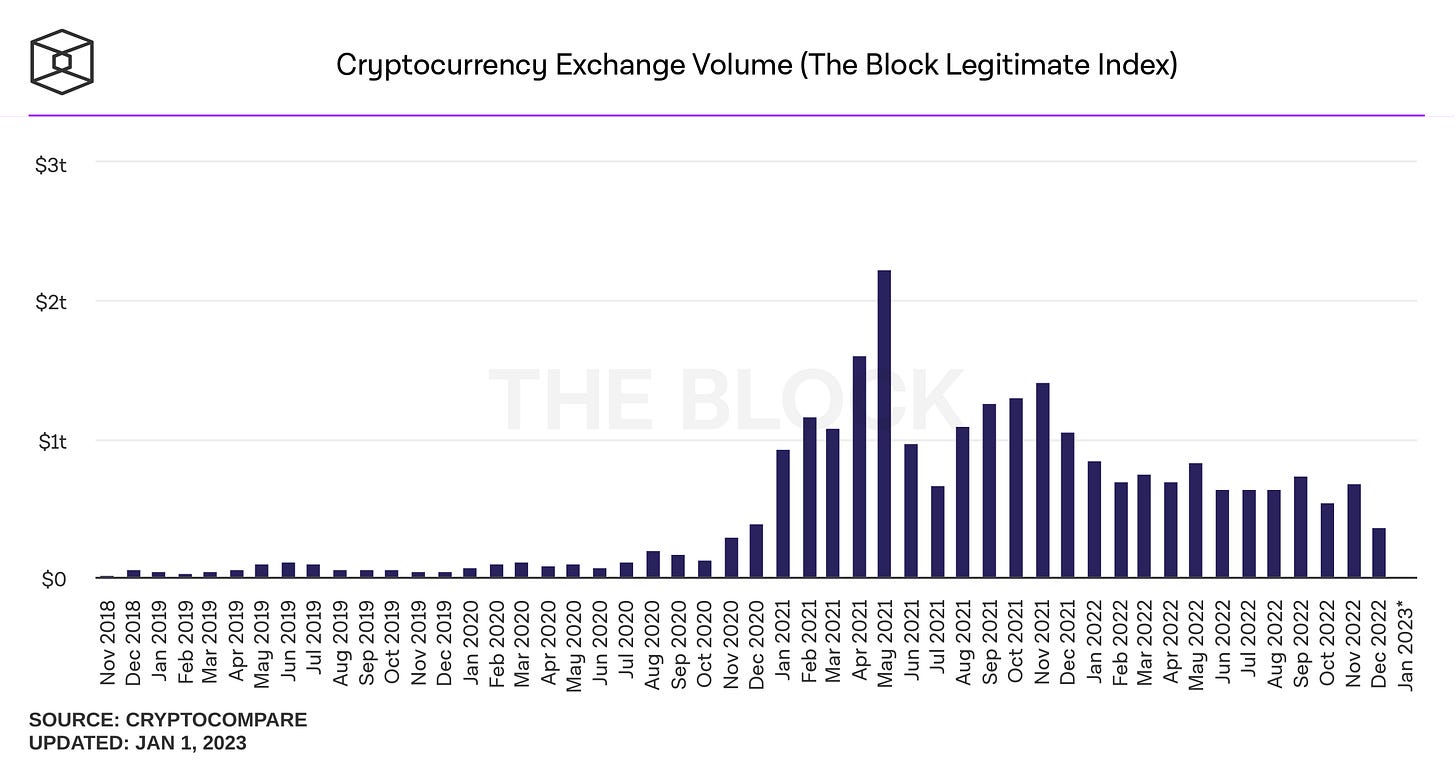

It is essential to understand that Coinbase primarily operates like a crypto exchange, charging users a % fee per transaction. If the crypto volume dries up on its exchange, Coinbase suffers a huge revenue hit, which is what happened in 2022.

Why did the trading volume dry up on Coinbase?

2022 was a terrible year for crypto — FTX fiasco, interest rate hikes negatively affecting crypto investment, and increased regulatory scrutiny (to name a few). All these factors contributed to bearish crypto sentiment, resulting in a decline in trading volume.

What does it mean for investors?

A beaten Coinbase stock is good news for investors planning to invest. Why?

Well, a decline in crypto trading volume is a temporal shock. As prices of blue chip crypto tokens (e.g., Bitcoin, ETH) recover (which is already underway), the trading volume would also recover (prices and trading volume have a strong direct correlation). Additionally, in the medium term, once interest rate hikes halt and inflation is under control, we will see another wave of investments into riskier assets, such as crypto, paving the way for higher trading volume and revenue for Coinbase.

Furthermore, investors should closely monitor the ETH Shanghai fork developments. The ETH Shanghai fork enables users to withdraw ETH they have staked since long ago. In others, users can increasingly stake ETH without worrying about locking their funds away for a long time. Why is this important?

From Coinbase’s perspective, this upgrade could result in a surge in retail customers staking ETH on Coinbase. It is important to understand that Coinbase takes a much higher cut for staking than transactions (25% vs. 4-5%), and a surge of staking volume could improve revenue. At the same time, with the new upgrade, Coinbase could also experiment auto-enrolling customers into ETH staking. This way, Coinbase could boost its ETH staking participation rate on its platform and, consequently, its revenue. In summary, the Shanghai fork presents an attractive revenue upside opportunity for Coinbase, and we should monitor its development.

Walmart: Earnings reflect broader consumer behavior

📝Quick Recap

Walmart's Q4 earnings beat the market’s expectations as it drew budget-conscious shoppers during the holiday season. Despite this positive news, the stock prices remained unchanged as Walmart provided weaker guidance for the upcoming year.

What was the driver behind positive earnings news?

In a high-inflation environment, households cut back on discretionary spending (e.g., electronics, apparel) and rebalance their budget towards essential items such as groceries. This change is great for Walmart’s topline as the retail giant generates a bulk of its revenue (xx%) from groceries.

If the shift in consumer behavior is great for Walmart then what’s up with the weaker guidance?

Groceries are not a high-margin segment. In other words, a larger shift towards groceries will hurt Walmart’s bottom line.

Walmart still has a high inventory of apparel and other general merchandise from last year, which it needs to offload. Management is not confident in the firm’s ability to do so as consumers continue to cut back on discretionary spending.

Inflation: What’s the update?

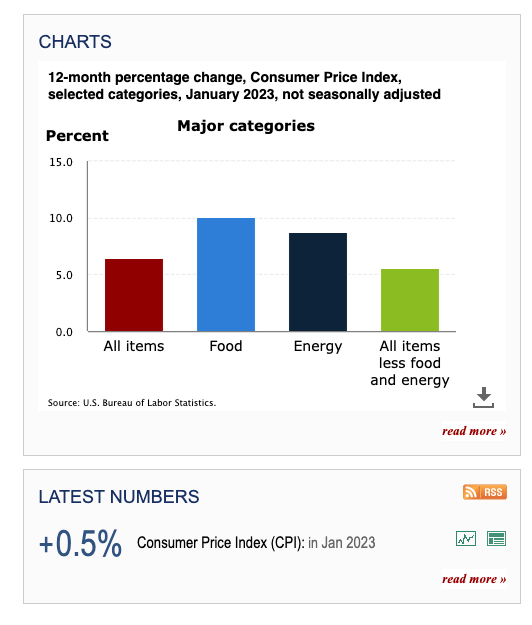

Despite the multiple rate hikes last year, Fed is facing difficulty taming inflation. Core inflation in January was up 4.7% vs. a 4.6% year-on-year increase in December last year.

Additionally, the job market is still surprisingly robust, which is not a good sign. Think about it. If the demand for labor is high, then wages will grow, meaning that consumers will have higher wages to pay for goods that are now more costly — reinforcing inflation.

As a result, it is quite certain that the Fed will further hike interest rates this year. The market expects the fed to hike interest rates three more times this year to control inflation.

🗒Weekly Headline Summary

Asia-Specific

Chip industry doubles down on Singapore as production hub|NK

China economy to rebound in 2023 under precise, forceful monetary policy: c.bank|RT

Nickel Shows Indonesia How to Escape the Middle Income Trap|BB

Beyond Asia

Warren Buffett’s Berkshire Hathaway Posts Big 2022 Loss in Rocky Market|WSJ

Supply Chains Have Healed Yet Their Mark on Inflation to Endure|BB

Domino’s Pizza, Wayfair, Nvidia: Stocks That Defined the Week|WSJ