2023 Week 9: Desensitised To Bad News

Nio reported 260% decline in net profit, Twitter lost 40% of its revenue, Median housing price has declined in recent months

💡Did you know? Coca Cola logo is recognized by 94% of the world’s population, making it one of the most popular brands globally.

Market Rundown:

Nio: Has Been A Rocky Road

📝 Quick Recap

Despite growing deliveries by 60% year-on-year, Nio reported disappointing earnings news. Its gross profit and net profits declined 25% and 260% respectively, driven primarily by ballooning battery, inventory provision, and SG&A costs.

🧐Analyze like a Consultant

Following a string of disappointing news, Nio’s stock has been severely beaten in recent years. It trades at a ~3x EV/Sales multiple while the industry average is close to 10x, indicating the market’s pessimism regarding Nio’s outlook.

What could Nio do to build investors’ confidence?

Shifting product mix to Nio’s NT 2.0 platform vehicles: Nio’s NT 2.0 platform vehicles outperform its legacy vehicles in all dimensions (battery range, performance, and safety). As a result, these vehicles, on average, are more expensive than their legacy counterparts. In other words, Nio should concentrate its marketing and sales effort on pushing these next-gen vehicles to boost its top line.

Nevertheless, it is important to understand that shifting the product mix to increase revenue per vehicle is a short-term strategy for Nio. Eventually, Nio needs to enter the mass-market segment to have a decent shot at increasing revenue (similar to what BYD is doing) and easing its pathway to profitability. Why?

EV adoption, especially in the Chinese luxury vehicle segment, is growing slower rate than hoped. ICE vehicles (e.g., BMW, Porsche, Benz) are still popular amongst the wealthy in China. Second, entering the mass-market segment will allow Nio to achieve scale faster, lowering the average cost per vehicle more rapidly than focusing solely on the luxury sector.

Increase Production Capacity: One of the key factors holding back Nio's growth has been its limited production capacity. The company has been struggling to keep up with the demand for its electric vehicles, leading to long wait times for customers and missed sales opportunities. Estimates suggest that ~50-60% of ET7 pre-orders were canceled due to delivery delays. Investing in new production capacity is key to addressing the abovementioned issues and positioning Nio well to execute and deliver on its mass-market strategy in the medium-to-long term.

Prudent cost management: Nio's SG&A costs have spirated out of control, increasing 40% yoy. Management should trim fat wherever possible to boost profitability in the near term.

Twitter: Keeps Getting Worse

📝 Quick Recap

In an investors update, Twitter reported a 40% year-on-year decline in revenue and earnings last month.

What drove this decline?

More than 75 out of 100 largest advertisers on Twitter have paused advertising on the platform (e.g., General Motors, Pfizer, Volkswagen), indicating concerns over content moderation and the possibility of their ads appearing next to controversial content. In other words, not a good sign for a company that generates > 90% of its revenue via advertising.

In a desperate attempt to prevent the outflow of advertisers, Twitter is offering incentives to retain them, which yielded no positive results.

“Under the new Twitter plan, advertisers who book at least $500,000 in incremental spending will qualify to have their spending matched with a “100% value add,” up to a $1 million cap” — WSJ

What does it mean for Twitter and Elon?

Simply put, disastrous. To ensure a decent shot at recovery, Elon needs to address three things urgently:

Content Moderation: Reducing headcount from 8000 to 2000 personnel and launching a Twitter subscription service will not drastically bring Twitter back to profitability. Instead, regaining lost advertisers will. To do so, Elon needs to change his stance on “free speech”, invest resources in revamping Twitter’s moderation policy and rebuild Twitter’s content moderation team.

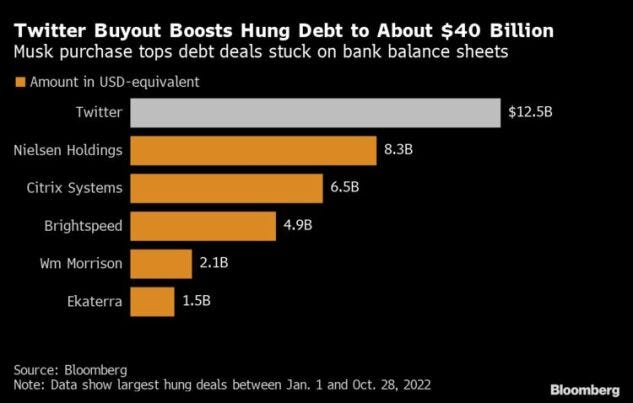

Figure out how to finance Twitter’s debt obligations: Elon still has to pay 15% in interest annually on the 13 billion loans he borrowed from banks to finance Twitter’s acquisition -- a lot in cash outflow for a company that is losing $4M every day. Elon has two options to overcome this:

Institutional buyers are not interested in purchasing the debt from banks, staying far away from Twitter in this economic climate. Elon could take the opportunity to ultimately purchase the debt for cents on the dollar, eliminating interest payments for Twitter altogether.

Raise capital (equity instead of debt) to pay off debt obligations entirely or raise enough capital to make the interest payments in the short to medium term. The downside of this strategy is equity dilution, which Elon needs to consider.

Nail down a long-term Twitter strategy: Elon has many ideas for Twitter (e.g., subscription service, strong content creator economy, fintech platform, etc.), but it is all up in the air. Elon and the rest of the management need to focus on creating a clear, long-term play to help him realize sizable value for Twitter.

Housing Market: Cooling Down

📝 Quick Recap:

On a year-on-year basis, the median house sale price has declined for the first time since 2012. What is the driver behind this decline in housing prices? Higher mortgage rate. Mortgage rates have increased drastically recently (6.5-7% per year vs. <3% previously), making interest payments too expensive for the average household. As a result, potential home buyers are stalling their house purchases, leading to lower median home sale prices.

🗒Weekly Headline Summary

Asia-Specific

Renewed China energy demand threatens to fuel global inflation|NK

Biden Closes In on Order to Restrict US Investment in China Tech|BB

China Sets Conservative Growth Target as Challenges Loom|WSJ

Philippines c.bank gov sees 50 bps rate hike if inflation tops 9%|RT

Beyond Asia

Euro zone inflation softens to 8.5% in February as ECB signals interest rate hiking is not over|CNBC

Sky-high Australian coal prices drop back to pre-Ukraine-war levels|NK

Citigroup Cuts Hundreds of Jobs, Including in Investment Banking and Mortgage Units|BB